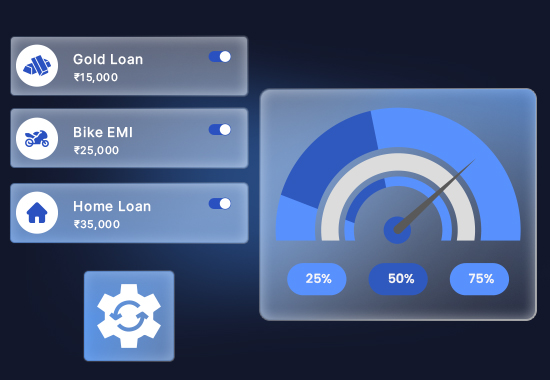

Feature-Rich

Start with Our Feature Frontier

Enhance your financial operations with cutting edge BFSI features and enhance efficiency and control by integrating them with your software.

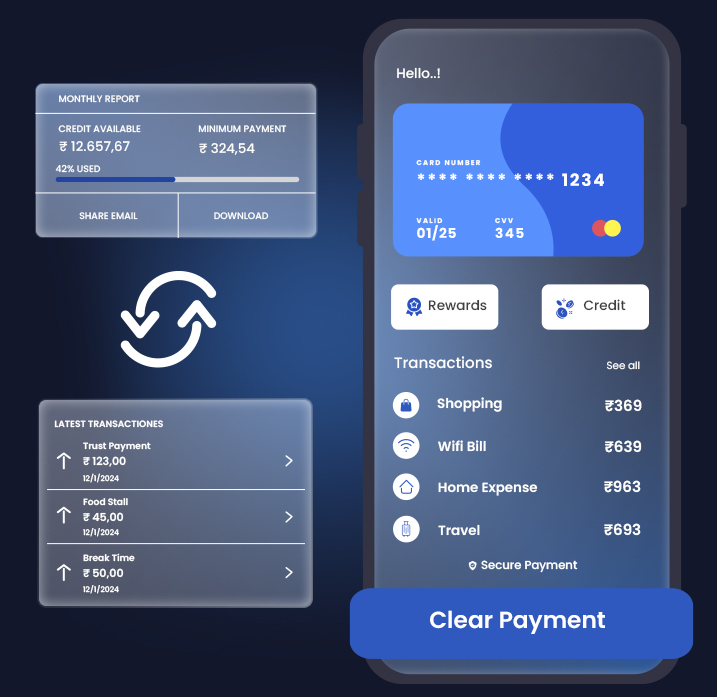

Flexible Billing

Customize payment cycles and billing schedules to suit your business needs, enhancing automation and personalization.

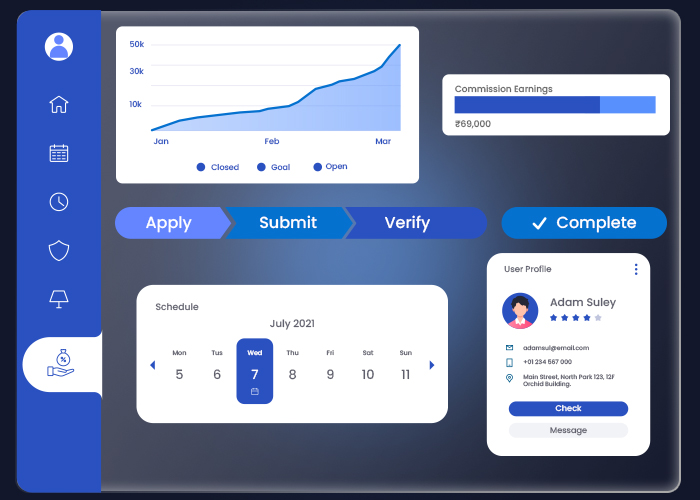

Effortless Onboarding

Quickly convert customers into subscribers using link-based e-mandates, simplifying the onboarding process.

Global Payment Support

Enable transactions worldwide with support for 92+ currencies and major cards, ensuring a seamless experience for international users.